Budget Summary

MARCH 2023

Our Tax Partner Ian Kelly rounds up Wednesday’s budget from Chancellor of the Exchequer, Jeremy Hunt.

Well, after all the advance hype and “leaks”, Chancellor of the Exchequer, Jeremy Hunt’s first Budget was something of a damp squib; always a problem when the “spoiler alert” has already taken place.

Hunt’s calm and gentle delivery would, in former days, have been shouted down by the opposition benches and lost in the “here, here’s” from his own benches. But with his softly-softly delivery, he was quick to announce his Budget was one “for growth and fiscal stability”,

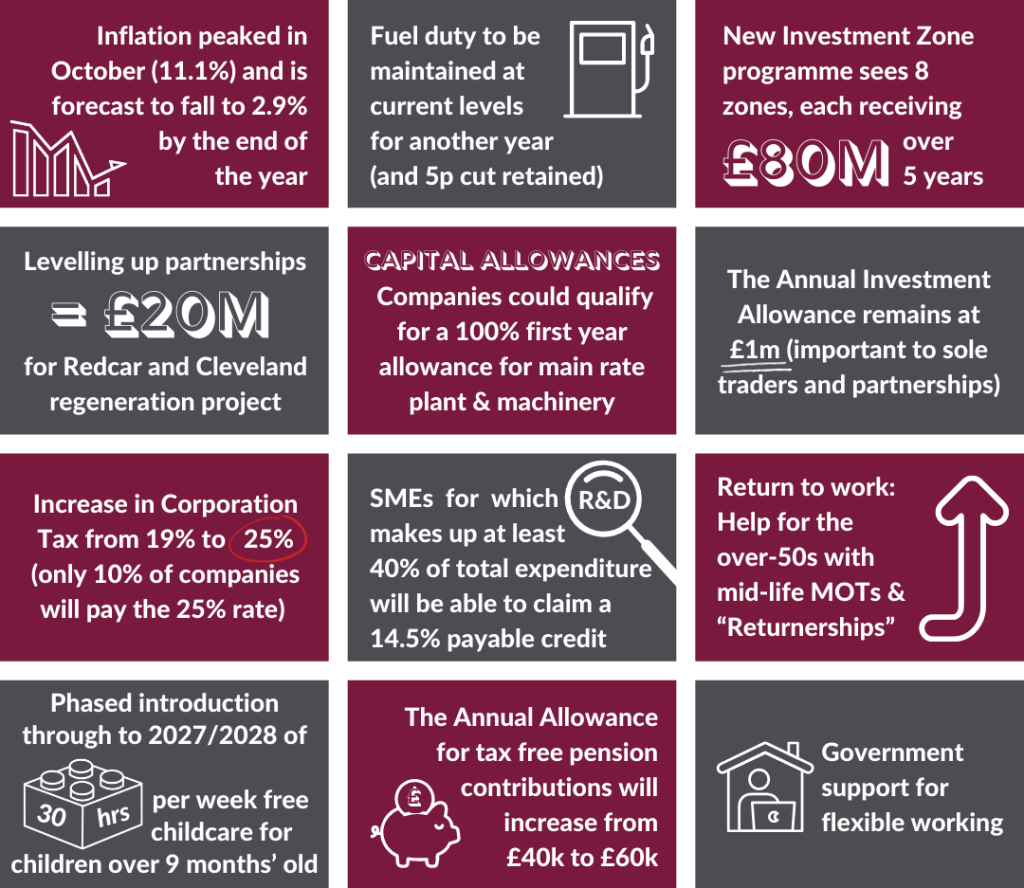

Hunt flagged up that inflation (11.1%) had peaked in October and was forecast to fall to 2.9% by the end of the year; mortgage rates were expected to fall as a result and that fuel duty would be maintained at current levels for another 12 months and the 5p duty cut retained.

All told, the government was committed to a £94bn support package, equivalent to an average for households of £3,300 and would extend the Energy Price Guarantee from April to the end of June.

The new Investment Zone programme sees eight zones, each receiving £80m of support over five years, in England and four across Scotland, Northern Ireland and Wales with, locally, the North East and Teesside, building on Freeport status, lined up to benefit from enhanced Capital Allowances; Structures and Building Allowance; Stamp Duty Land Tax, Business Rates and Employer National Insurance Contributions reliefs and access to flexible grant funding.

Having championed these Zones as being, potentially, another 12 Canary Wharfs, Hunt went on to announce an extra £400m for levelling up partnerships including Redcar and Cleveland and £20m for the same area’s regeneration project.

Round three of the Levelling Up Fund would follow later this year with a £1bn fund to level up places across the UK

Hunt, in mentioning the ending of the Capital Allowances Super Deduction at the end of March, said that for three years from 1 April 2023 companies could qualify for a 100% first year allowance for main rate plant and machinery to be known as “full expensing”. Special rate assets would qualify for a 50% first year allowance.

The Annual Investment Allowance would remain at £1m and which is of particular importance to sole traders and partnerships who are unable to use the Super Deduction or full expensing.

The increase in Corporation Tax from 19% to 25% would still happen but, Hunt said, only some 10% of companies would pay the 25% rate.

The consultation on merging the Research and Development (R&D) Expenditure Credit (RDEC) and the Small and Medium Enterprises (SME) R&D schemes closed on 13 March and the government retains the option of introducing a merged scheme from April 2024.

An enhanced R&D relief from 1 April 2023 was announced with a higher rate of relief for R&D intensive SME’s who make a loss. SME’s for which qualifying R&D makes up at least 40% of total expenditure will be able to claim a 14.5% payable credit for qualifying R&D expenditure.

The need to try and fill the estimated 1.1 million employment vacancies saw support measures to help those with health conditions more easily remain in their jobs or return to work. There was also help for the over-50’s in the shape of mid-life MOT’s and a variation on apprenticeships in the form of “Returnerships”. It was interesting to hear that Office for National Statistics have advised that “almost nobody” of the 3.5 million out of work over 50’s intended returning to work and so this initiative might be hard work if you pardon the pun.

As with the return-to-work support, the increase in child care support had been leaked prior to the Budget and which would see a phased introduction through to 2027/2028 of 30 hours per week free childcare for children over nine months’ old.

Another advance rumour that came to fruition was the increase in pension tax thresholds which had hit the medical profession in particular with Hunt saying that tax consequences should never force anyone out of work. The Annual Allowance (AA) which limits the tax free figure of pension contributions will increase on 6 April 2023 from £40,000 to £60,000 and there will remain the ability to carry forward unused AA from the three previous tax years. There will be an increase in the Money Purchase Annual Allowance from £4,000 to £10,000; the same increase for the Tapered Annual Allowance (TAA) with the adjusted income threshold for the TAA rising from £240,000 to £260,000 all from 6 April 2023. Also from that date, the Lifetime Allowance Charge will be removed before its abolition most likely in April 2024.

Hidden away in the latter pages but worthy of a mention are the government’s support for Private Members Bills that would provide for an at day one right to request flexible working; the government bringing forward a call for evidence to launch this Summer on the topics of informal and ad-hoc flexible working to better understand informal flexible working agreements between employers and employees and the roll out of an IT system to enable tax agents to payroll Benefits in Kind on behalf of employers.

To conclude and summarise, therefore, with Hunt’s hands tied by the already frozen personal tax allowances, reliefs and tax rate bands, and the increasingly common advance “leaks”, there was, arguably, very little to get ultra-excited about.

We now have to await “his” Autumn Statement later this year.